The Old-Fashioned Method

Welcome, here you will learn how to traverse the slow and steady path to permanently removing these negative collections on your credit report. Since this is the personal path that I took to better my credit, I will be explaining it via my viewpoint. Without further ado, let's begin!

DISCLAIMER

As I mentioned previously on the main dispute page; disputing must be done when and only after you have frozen and opted out of all 8 Credit Reporting Agencies. Remember, when disputing items on your credit report, the entity reporting your items MUST prove that the negative items are accurate and belong to you. They can't verify anything if no one is allowed to tell them what the truth is can they? Wink-Wink 😜

MAKE YOUR LIST

Lining Up Your Ducks

Know Your Enemy

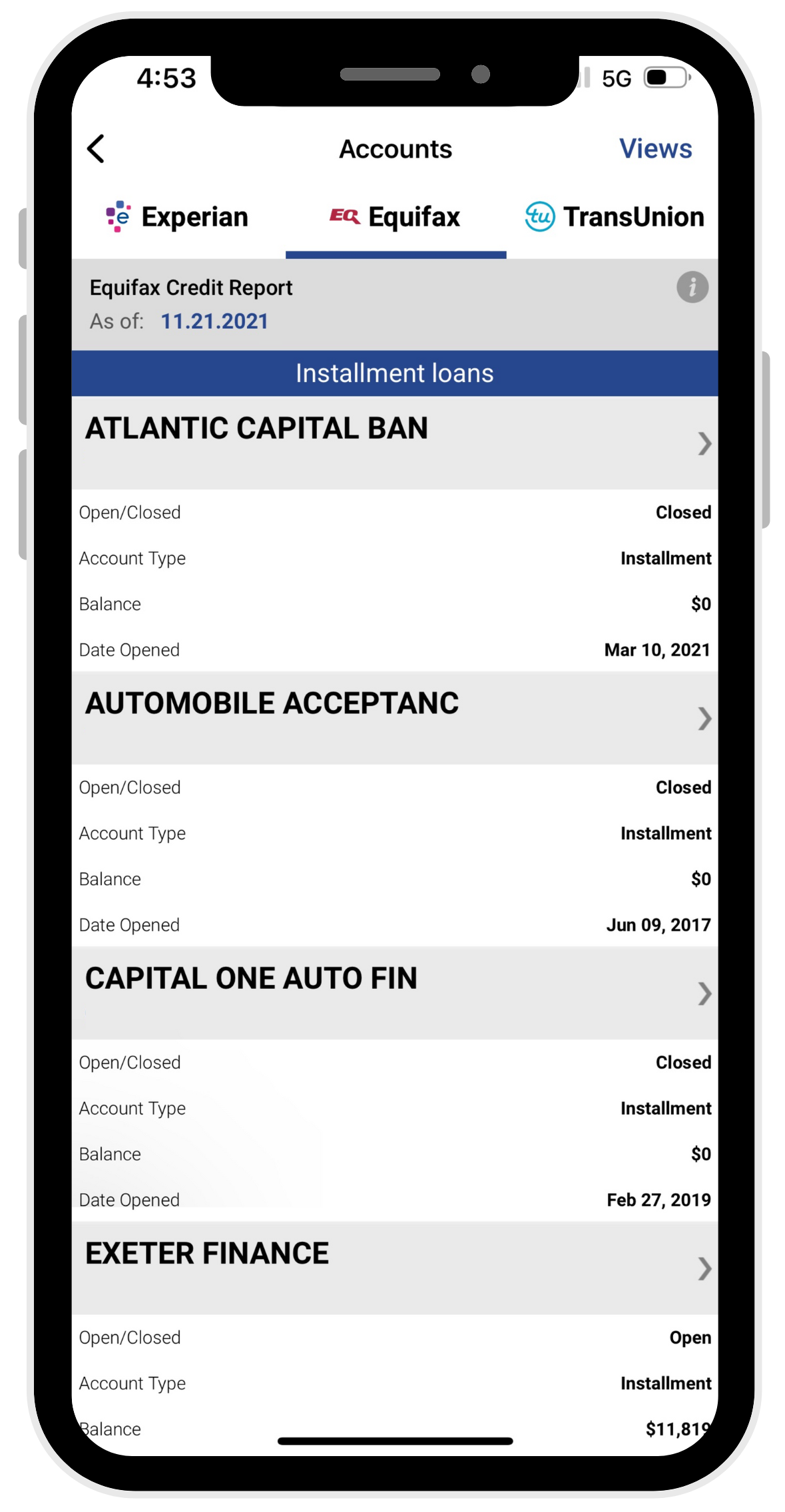

As I mentioned previously, we are going to be using Experian to identify what the negative items are and who the Collection Agencies are that are responsible for reporting them.

Make Your List

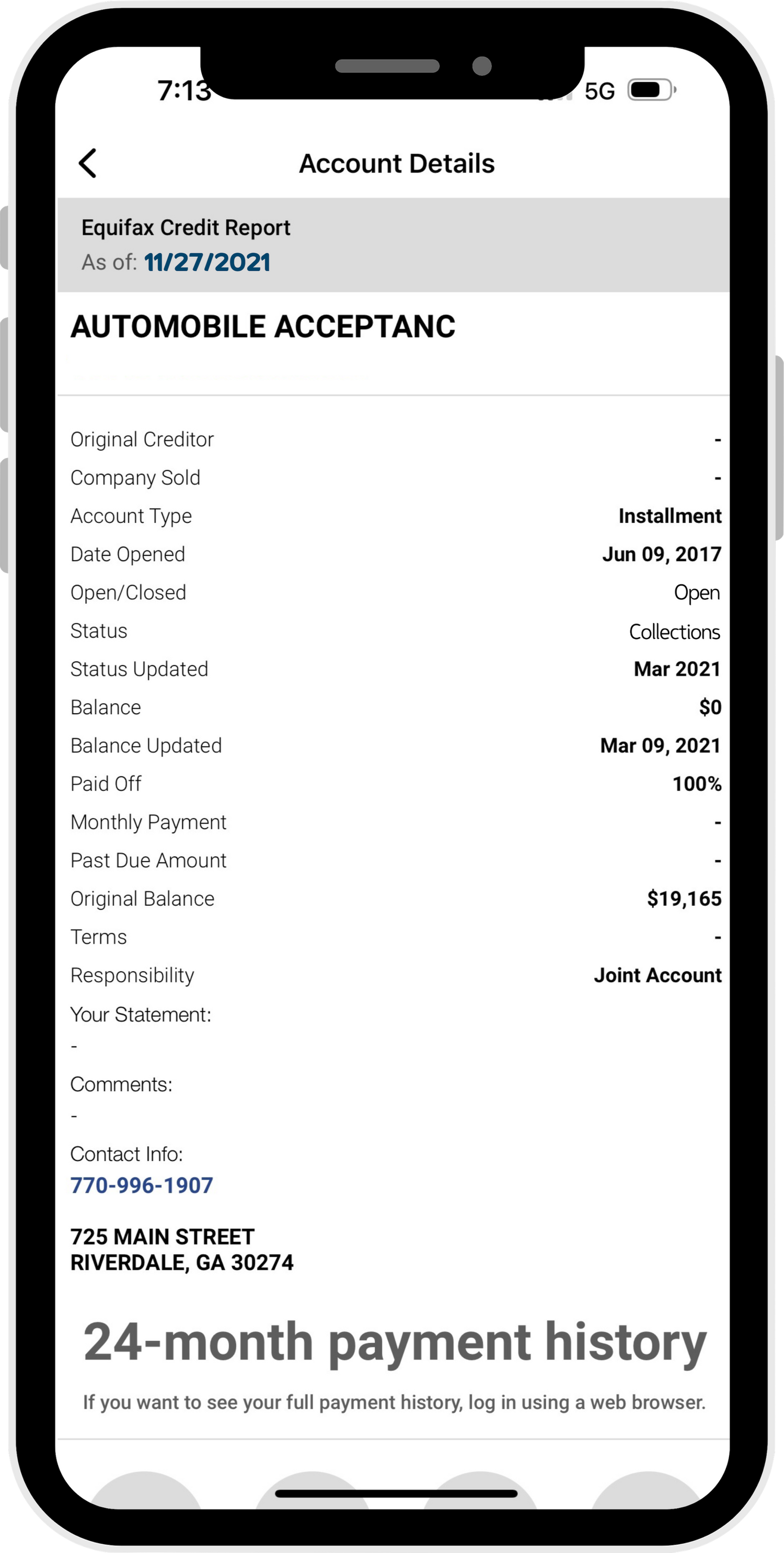

Create a list of all the Collection Agencies. Be sure to jot-down their names as it appears, their phone numbers, and address (if any).

TIP

In most cases, the Collection Agency on your file submitted incorrect information that makes it hard or near impossible to get in contact with them. You can do either of these 2 things to get in contact with them. OPTION 1: If you remember the original debt holder, you can contact their collection department and ask who they contracted to collect on their behalf. OPTION 2: Collection Agencies "loooooove" to call and harass you to collect their money. Use this to your advantage to collect the information you need to file your dispute.

ATTACK SEQUENCE

Storming The Castle

Verify "Your" Debt

Once you've collected the contact information of your specified debt collector, you need to call them and have them verify the information they have of you. Have them mail the information to you.

In Writing....

Once you've verified the mailed debt belongs to you, contact the debt collector and agree to pay either in full or a lesser agreeable amount. Have them mail you proof of the agreement.

ALL OUT ATTACK

Going In For The Kill

One Shot Kill

Once the last payment is made, make sure that the Debt Collector mails you the final payment disclosure letter. Ensure the letter received verifies that "you no longer have a debt" and that it has either been "paid in full" or has been "settled for a lesser amount."

The Golden Path

Now that you have the necessary documentation to clear up the negative records on your account, your path will now get a whole lot easier.

GROUND ZERO

EXPERIAN DISPUTE CENTER

Waiting Game

Now that the hard work is out of the way, all that needs to be done is wait. Dispute results usually accure after a 30-day span. Once that is over, you will receive an update to your credit report with those negative items removed.

CONCLUSION

If you have followed all of my steps to the "T", you should have those negative items removed permanently from your credit report. If for some reason my personal experience hasn't helped, feel free to explore my Modern-Fashioned Way path or hire someone to assist. Click the "Dispute Center" button below to get started.