The Modern-Fashioned Method

Take a dive into the fast lane! Here, you will learn the modern day tricks of the trade to remove negative collections on your credit report. Without further ado, let's begin!

DISCLAIMER

As I mentioned previously on the main dispute page; disputing must be done when and only after you have frozen and opted out of all 8 Credit Reporting Agencies. Remember, when disputing items on your credit report, the entity reporting your items MUST prove that the negative items are accurate and belong to you. They can't verify anything if no one is allowed to tell them what the truth is can they? Wink-Wink 😜

MAKE YOUR LIST

Lining Up Your Ducks

Know Your Enemy

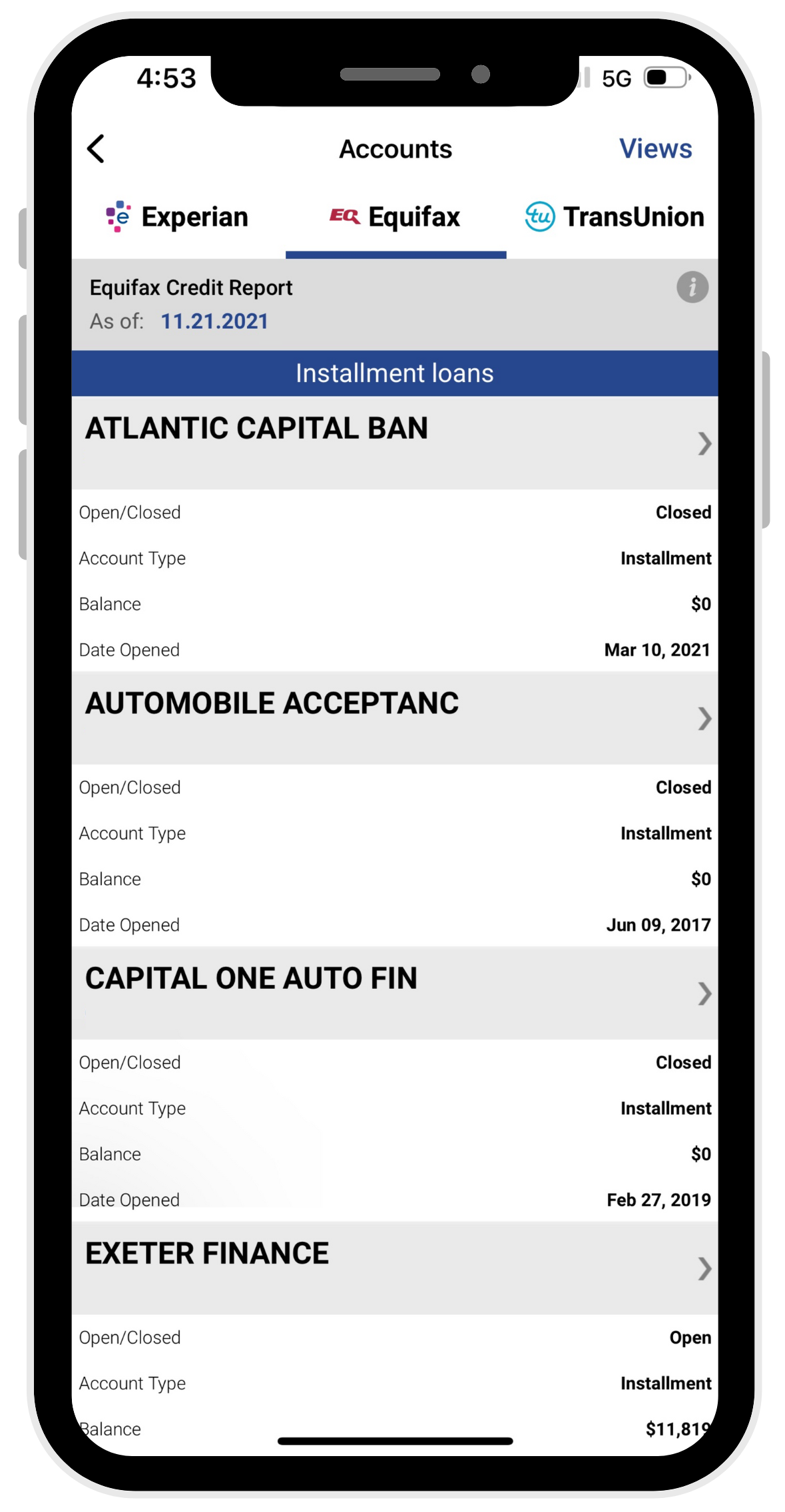

As I mentioned previously, we are going to be using Experian to identify what the negative items are and who the Collection Agencies are that are responsible for reporting them.

Make Your List

Create a list of all the Collection Agencies. Be sure to jot-down their names as it appears, their phone numbers, and address (if any).

TIP

In most cases, the Collection Agency on your file submitted incorrect information that makes it hard or near impossible to get in contact with them. You can do either of these 2 things to get in contact with them. OPTION 1: If you remember the original debt holder, you can contact their collection department and ask who they contracted to collect on their behalf. OPTION 2: Collection Agencies "loooooove" to call and harass you to collect their money. Use this to your advantage to collect the information you need to file your dispute.

Verify "Your" Debt

Once you've collected the contact information of your specified debt collector, you need to call them and have them verify the information they have of you. Have them mail the information to you.

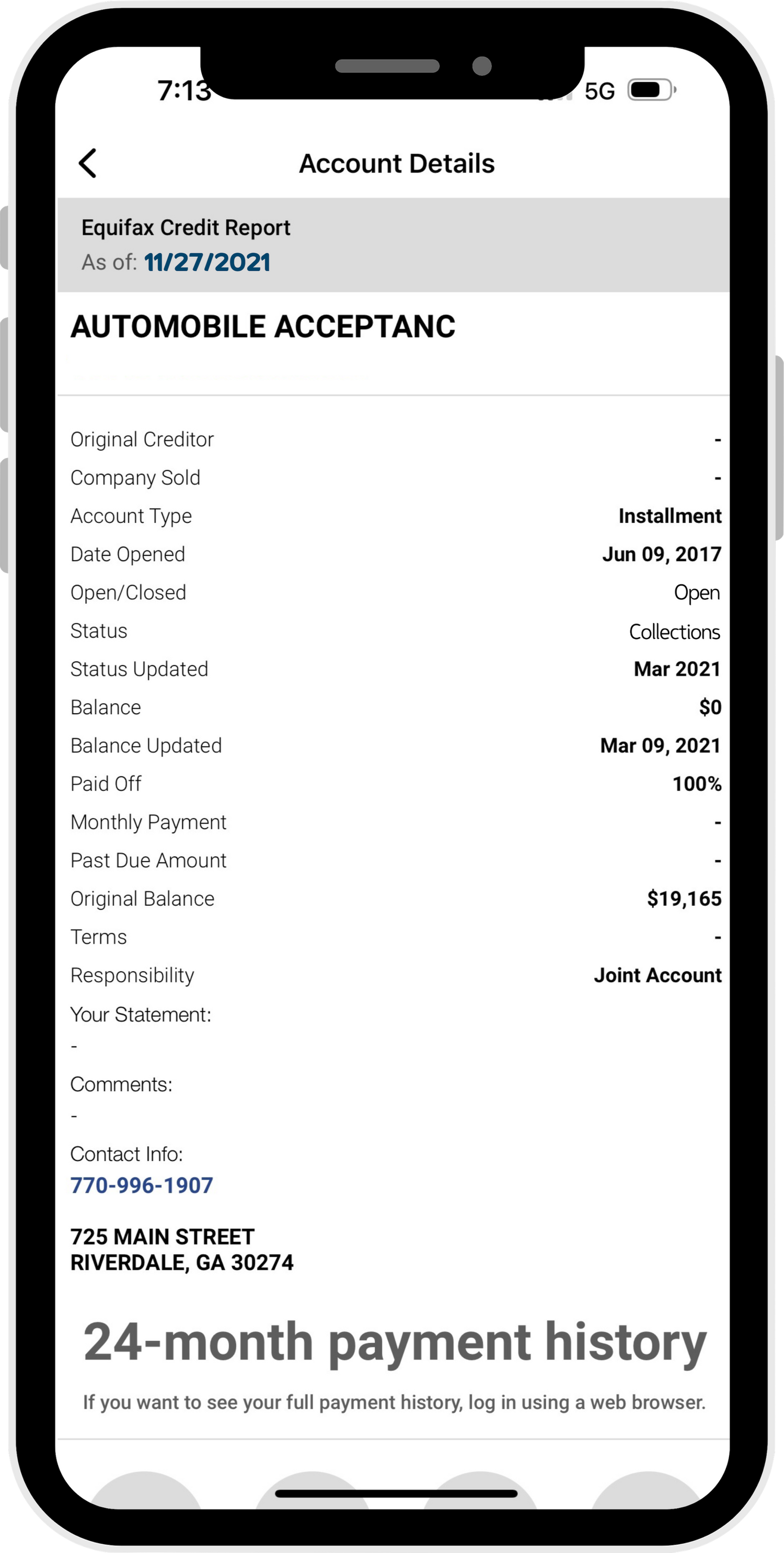

Yin & Yang

Using the letter the Collection Agency sent you and your current Credit Report, you will look for inaccuracies in between the two.

SWIPE TO VIEW

Getting The Word Out

When Writing Your Letters...

Using the letter templates I have provided above, you will tailor these to your need. Be sure to send letters like these in succession to the (3)three Main Credit Bureaus; Experian, Equifax, Transunion.

Intimidation Tactics

Letters tend to fall on deaf ears whenever you're sending them to the Credit Bureaus. Nonetheless, do not let these minor setbacks deter you from succeeding. Sometimes, it requires a little more coercion on your behalf to get the 3 Bureaus to respond.

Trap Mail

Writing time sensitive letters are perfect trap tactics to force bureaus to remove negative accounts on your report. Write these once you recieve your debt confirmation letter.

ALWAYS REMEMBER

The Collection Agency & Credit Bureaus are "Required By Law" to Respond & Prove within a 30 day period that you do in fact owe the presumed debt. If they cannot procure sufficient documentation or respond they "MUST" remove the "inaccurate information" per the Fair Credit Reporting Act.

THE FINAL STAGES

Legal Obligations

Litigation

M.I.A. (Missing In Action Cont.) This route is sometimes the most time consuming but the most rewarding. Click the "Learn More" button below to learn more.

TOUCHDOWN

Once you've completed your agreement with the Collection Agency, just wait for their letter in the mail and then submit that to the bureaus when you dispute it with them. Within a few weeks, it will be taken off of your credit report.

THE END

If you have followed all of my steps to the "T", you should have those negative items removed or at least have gotten yourself a better understanding as to how to get to where you need to be. If for some reason my "Step-By-Step" guide wasn't enough to help you out with your particular credit situation, feel free to hire someone to assist. Click the "HIRE HELP" button below to get started.